- Home

- Contact Us

Contact Us

Perfekt's Staff Is ready and waiting to field your inquiry.

Got A Question?

We've Got The Answers

Stop worrying about when you are going to get paid and start concentrating on what’s really important: running your business.

Feel free to contact us with any questions and we will be happy to get back to you as soon as possible. In the mean time, sign up for your free account so you can protect yourself today.

Locations We Serve

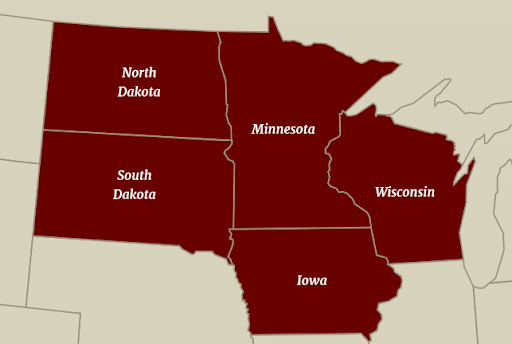

Perfekt proudly serves the construction industry in Minnesota, Wisconsin, South Dakota, North Dakota, and Iowa.

F.A.Q's

Your Questions Answered

To “perfect” is to make something completely free from faults or defects, as in to perfect a process. The name Perfekt is a play on the word, replacing the C with a K to reflect our culture of creating a fun work environment.

Construction lien rights are the legal rights of a contractor to foreclose on a property in the event of non-payment for the contribution of labor and/or material to the improvement of a property. Prior to foreclosure, a lien must be placed against the property, which clouds the title and impedes the transfer of property ownership. Prior to filing a lien, the right to do so must be managed according to state statute, and the laws differ from state to state.

Managing lien rights is a multi-step, time-line driven process. Miss a step or miss a timeline, and a contractor could jeopardize lien rights, and ultimately the right to foreclose on a property in the event of non-payment.

By managing lien rights, contractors and suppliers put themselves in an improved position to get paid. Managed lien rights create lines of communication with all the parties involved, and informs property owners which contractors and suppliers are working on or supplied materials to their projects. Managing lien rights may improve cash flow and the timing of payment. If lien rights are managed and contractors or suppliers are not paid, the contractors and suppliers may file a lien against the property, and then begin foreclosure actions to recover payment.

Properly managing lien rights opens lines of communication between all parties, as well as potentially improves the timeliness of payment – which in turn may improve cash flow that allows for new growth.

Attorneys are expensive. Managing lien rights in-house can be daunting. Using Perfekt’s technology-driven processes is easy. Perfekt is more cost effective than most in-house processing and almost all attorneys. Perfekt’s system of tracking statutory timelines and reporting is a great accounts receivable tool. Helping manage lien rights is all we do!

Perfekt offers Preliminary Lien notices (preliens), Notice of Intents to Lien (NOI or Secondary Lien Notice – Perfekt currently only offers this service in states that require a notice of intent to be sent to maintain lien rights), Construction Liens, Bond Claims, Satisfaction of Liens, and marketing services through our affilate marketing partner Aelieve.

If a lien was perfected and filed with the county, the next step would be to begin the foreclosure process. Perfekt does not offer foreclosure services, but our system tracks the timeline up to foreclosure. In the event of foreclosure, we do have a close relationship with one of the best construction attorney firms in the Midwest and would love to get you in contact with them.

All contractors, material suppliers and builders that have contributed labor and/or material to the improvement of a property have lien rights as soon as they begin a project (some states restrict rights for lower tier subcontractors such as subs of subs). In order to keep/maintain lien rights after work has begun, certain steps must be followed based off state statutes. Each state has different required steps and statutory timelines.

Each state is different, so beware! In some states, if the project owner has paid for the services of a construction professional BEFORE the construction professional has served a preliminary notice to the property owner, the lien rights of the construction professional are VOID. A best practice for managing lien rights for a construction professional is to serve the preliminary notice on the first day of work, and do it for every project; remember, prelien early and prelien often.

Yes, if a construction professional has properly perfected and managed their lien rights, and the project owner has paid the general contractor for the construction professional’s services, but the general contractor has not paid the construction professional, then the lien laws of most states put the property owner in jeopardy of paying twice in order to keep the property title clean and not clouded.

Each state is different, but in general, funds received by a general contractor from a project owner must be held in trust for that project. The most common example of theft by contractor is when a general contractor uses the funds for project A to help cash flow project B. The practice is common and likely with good intent, but can be a house cards ready to tumble. This is one of many reasons for construction professionals to manage their lien rights.

Over the years, a lien has been a four-letter bad word. That sentiment is changing as managed lien rights becomes a best management practice for receivables. General contractors and developers are now exposed to such practices and most understand it is good business. General contractors (GC) are typically concerned about two things: (1) will the project owner be able to determine the GC’s markup based on a stated dollar value in a notice; and, (2) will a notice upset or confuse a project owner. To address number one, a project owner should request a lien waiver from every construction professional, so the project owner would know their price anyway. And number two, the purpose of the notices is to inform and protect the project/property owners. Managing lien rights postures your company as one that takes the proper steps to ensure payments flow properly, and if a general contractor asks you not to prelien or lien, that should be a red flag.

As a best management practice, every subcontractor and material supplier should have a lien management policy. This should include a dollar threshold for serving prelien notices and filing liens. The time to pull the trigger to file a lien might be tied to the terms of your invoices. But to manage the many gray areas around preliminary notices, we suggest to serve preliminary notices on the first date of work, for both commercial and residential projects. Then begin tracking the statutory timelines for next steps, if needed. Use a third party service such as Perfekt to help manage your lien rights (contact Perfekt if you’d like to discuss a lien management policy tailored for your company).

A statutory timeline is the state-driven timeline, created by each state, of which certain aspects of the lien management process must be completed. A prelien (when required) has a different statutory timeline than a notice of intent or lien. Generally, these timelines are based on time passed since the first date of work, or time passed since the last date of work. If a certain aspect of the lien law isn’t completed before the statutory deadlines, then that construction professional would lose lien rights to that property. For example, if a prelien is required and is not served within the proper timing, and then a construction professional desired to file a lien on the property, the lien rights would not be perfected and a lien would not be valid.

In general, the contribution of labor and/or material that creates a higher and better use of a property is considered an improvement to the property. There is a distinction between contributing to the improvement of a property and maintenance of a property. Maintenance may or may not be considered an action that supports lien rights.